vt dept of taxes forms

Estate and Inheritance Taxes. Vermont Department of Labor 5 Green Mountain Drive PO.

Vermont Department Of Taxes Montpelier Vt Facebook

TaxFormFinder provides printable PDF.

. To apply for registration and title if applicable. If claimants believe their 1099-G to be incorrect. Vermont School District Codes.

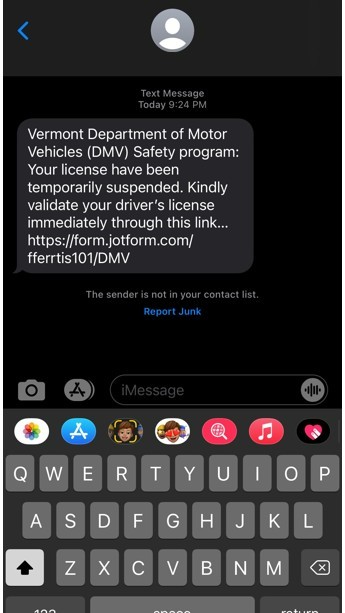

Register or Renew a Vehicle Find all of the resources you need to register and renew your vehicle in Vermont. Get the up-to-date vermont dept of taxes form sut 451 2022 now Get Form. Use myVTax the departments online portal to e-file and submit Form PTT-172 Property Transfer Tax Return with the Department of Taxes and the municipality with a.

Reminders and Resources. W-4VT Employees Withholding Allowance Certificate. Box 488 Montpelier 05601-0488 802 828-4000.

Dealer Renewal Packet - includes DMV forms VD-006 VD-008 VD-114 VD-114a. 43 out of 5. Estates Trusts and the Deceased.

Vermont dept of taxes form sut 451. C-36 Notice of Change. Information provided on 1099-G forms is based on the records of the Unemployment Insurance Division of the Vermont Department of Labor.

TaxFormFinder provides printable PDF. W-4VT Employees Withholding Allowance Certificate. Vermont School District Codes.

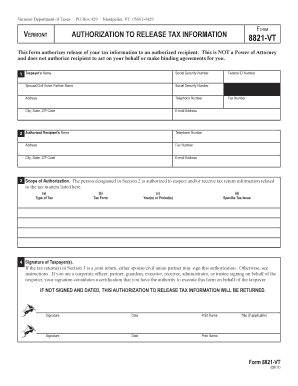

Vermont has a state income tax that ranges between 335 and 875 which is administered by the Vermont Department of Taxes. Taxes for Individuals File and pay taxes online and find required forms. PA-1 Special Power of Attorney.

The Department will mail your 1099G no later than January 31 2021 as. Fix or Correct a Return. VT Dept of Taxes Helpful Information.

C-49 MEMORANDUM OF UNDERSTANDING - for 3rd Party Reporter. C-45 Waiver Request Form. If you were paid unemployment insurance benefits in 2020 you will receive a 1099G form for your tax filing.

C-101-Form-and-Instructionspdf 56499 KB File Format. Used for new transactions transfers renewals title-only. VT Department of Taxes Sales and Use.

IN-111 Vermont Income Tax Return. PA-1 Special Power of Attorney. Vermont has a state income tax that ranges between 3350 and 8750.

January 29 2020 January 29 2020 WhitingWebmaster Leave a comment. Request a Copy of a Tax Return. C-50 Limited Power of Attorney.

IN-111 Vermont Income Tax Return. To order DMV stickers forms manuals and other supplies by licensed Vermont Dealers. Vermont has a state income tax that ranges between 335 and 875 which is administered by the Vermont Department of Taxes.

C-29A Large Employer Online Reporting.

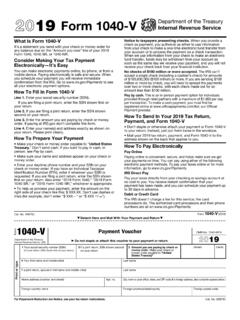

5 Mailing Or Delivery Service Tips For Paper Tax Return Filers Don T Mess With Taxes

Instructions Myvtax Vermont Gov You Also May E File This Vermont Department Of Taxes Pdf4pro

Vermont Department Of Taxes Form Fill Out And Sign Printable Pdf Template Signnow

Instructions Myvtax Vermont Gov You Also May E File This Vermont Department Of Taxes Pdf4pro

California Tax Forms H R Block

Vermont Department Of Taxes Need A Vermont Income Tax Booklet Including Forms Stop By 133 State Street In Montpelier Go Around The Back Of The Building And Take One From The

Free 10 Sample Tax Exemption Forms In Pdf

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

Free Vermont Tax Power Of Attorney Form Pa 1 Pdf Eforms

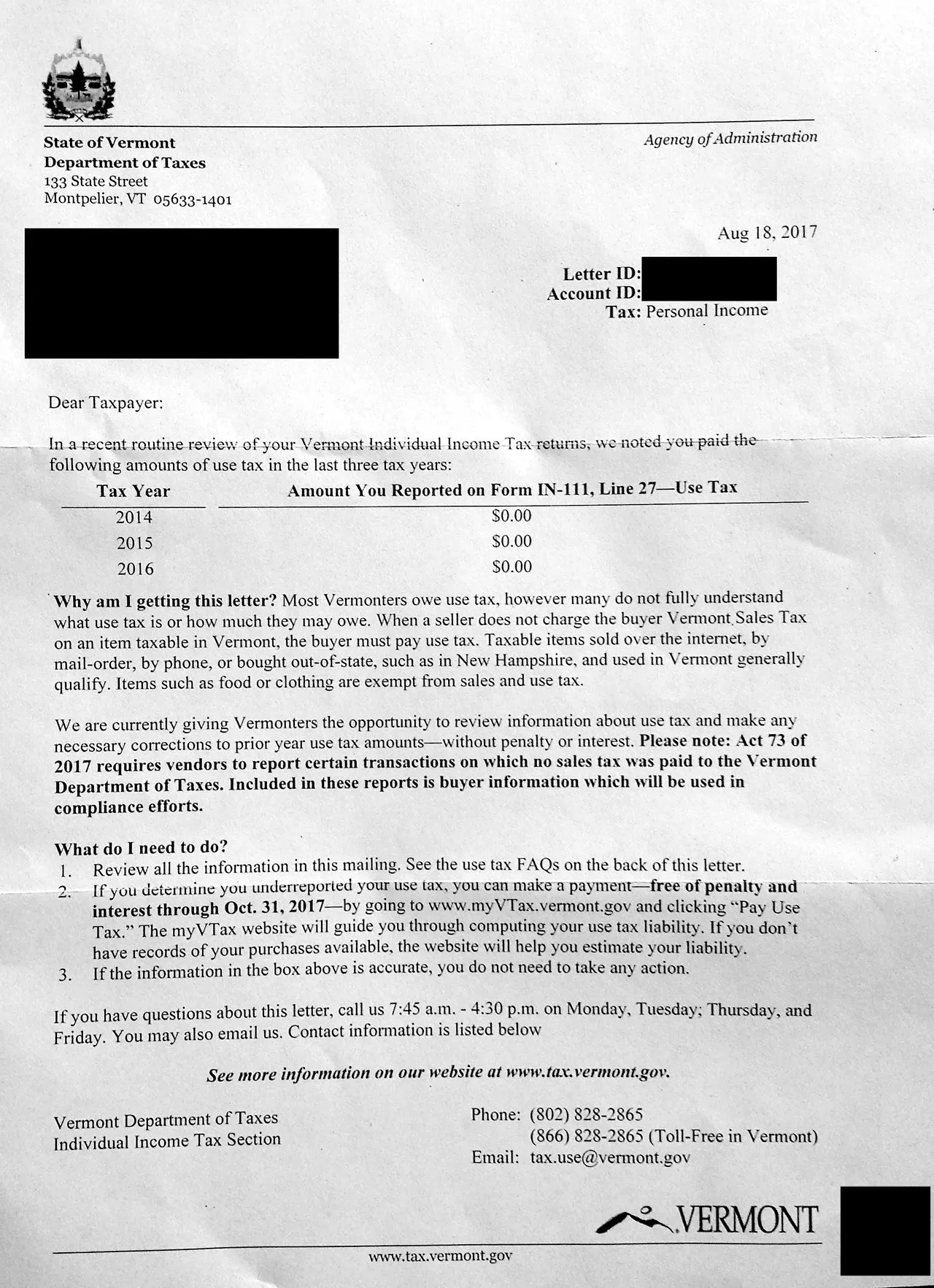

Vermont Tax Department Sends Letters Seeking Unpaid Sales Tax Off Message

Wht 436 Fill Out Sign Online Dochub

Vermont Department Of Taxes Montpelier Vt Facebook

Vt Dept Of Taxes Vtdepttaxes Twitter

State W 4 Form Detailed Withholding Forms By State Chart

Publications Department Of Taxes

Publications Department Of Taxes